December 12, 2022

# 3: Follow the Money – The Case of Brazilian Agri-investments

Brazil has been a popular destination for institutional investments in agribusiness (and the underlying land), even though national regulation prohibits foreigners to own large tracts of land. Samuel Frederico is a geographer at São Paulo State University, Brazil, and will open our Guest Writer Series, by discussing the challenge of ‘following the money’ in such an environment. In particular, he discusses the legal complexity of networks of delegation, intermediary constellations, and the concrete channels through which foreign investors acquire Brazilian agribusiness companies.

***

Following the flow of money behind financial investments in agribusiness is perhaps one of the most significant methodological challenges of research in this area. In many contexts, the difficulties are compounded by the lack of transparency about the true owners of some agricultural companies and the difficulty of identifying the investors behind the financial funds. When investigating financial investments in Brazilian agribusiness, one notices the creation by institutional investors of multiple companies with different names and legal registrations to hide the true identity of the investors, as well as the lack of transparency about the ultimate investors that capitalize the returns from agri-investment funds.

Agro-industrial processing in the soy frontier of the Southern region of Piauí, Brazil. Source: Frederico 2017.

Faced with these obstacles, we share some notes and research experiences on the theme. Since 2012, we have developed research on the relationship between financial capital and agribusiness in areas of the Brazilian agricultural frontier expansion [1]. Perhaps the cases and methodological procedures explained here will serve as examples for other researchers interested in the issue. The analysis of the relationship between financial capital and agribusiness imposes at least a double challenge on us: 1) to follow the flow of money upstream, that is, seeking to identify the investors behind financial funds and agricultural companies; 2) to analyze the concrete practices through which financial capital over-accumulated on a global scale reaches places, that is, materializes in land appropriation, in the (re-)constitution of farms, in social relations, in everyday practices and conflicts.

Another factor that makes it challenging to identify the foreign controllers of some Brazilian agricultural companies is the legal impossibility for foreign investors to acquire large amounts of land in the country. Many foreign investors seek partnerships with Brazilian investors or even create companies in the name of third parties to access the national land market. Perhaps these are the reasons why two US investors – a large pension fund and an endowment fund of a major university in that country – have created a series of front companies legally registered in Brazil in the name of Brazilians (often partners in the investments or high-ranking employees of the investing companies). By operating in the national land market as if they were national companies, they circumvent the law that restricts access to land by foreigners and does not link their names with illegal practices of appropriation of public lands and conflicts with traditional communities.

The chain in the photo is used for the deforestation of Cerrado vegetation. Farm operators put a tractor on each end and run the chain above the vegetation. Source: Frederico 2017.

In both cases, the agricultural companies controlled by the US investors had been accused by Brazilian social organizations of buying illegally appropriated land, a process known as “grilagem outsourcing”, i.e., buying public lands appropriated unlawfully by third parties.

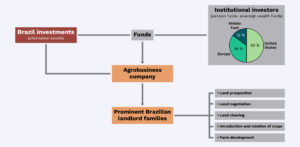

In the opposite direction, the question is how financial investors from distant countries do to access the local land market. The answer to this question lies in the need to establish partnerships with large Brazilian farmers and agricultural companies. Local agents are crucial to accessing the land market. Their functions range from land prospecting to farm development, land purchase, deforestation, and the withdrawal of small producers. Perhaps the best example of the multiscalar relationship for land acquisition in Brazil is the relationship between large producers, agricultural landowners, and institutional investors. Starting in the second half of the 2000s, financial firms specialized in alternative asset management emerged in Brazil with a focus on attracting foreign institutional investors willing to invest in real alternative assets in Brazil (urban real estate, farms, planted forests, and companies). These companies manage several financial funds capitalized by institutional investors, pension funds, equity, and sovereign wealth funds, especially from the USA, Western Europe, the Middle East, and Asia.

Agricultural investment funds and their local intermediaries in Brazilian large-scale farming. Source: Frederico 2022.

After structuring the funds and raising the necessary resources, the alternative asset management companies create or acquire companies that function as their operating arm in acquiring land and agricultural production. The main focus of these companies is to capitalize on land rent by transforming natural areas into high agricultural productivity farms. To rapidly increase their land portfolio and facilitate land identification, acquisition, and management, these companies partner with groups of Brazilian farmers who own farms distributed in different regions of the Brazilian agricultural frontier. Usually, the partnership is established by exchanging some farms for equity participation in the agricultural companies.

The example above illustrates a recurring case of the global phenomenon of land grabbing. It articulates agents with different scales of action, ranging from those acting worldwide, such as international institutional investors, to regional producers, not forgetting the necessary intermediation of companies operating at the national level. In other words, the relations mediated by these alternative asset management companies allow us to identify the multiscale network of articulations aiming at capital accumulation via land investments. The flowchart above summarizes the relations established by these investment funds for the acquisition and control of land in agricultural frontier areas in Brazil.

[1] Spadotto B, Saweljew YM, Frederico S, et al. (2020) Unpacking the finance-farmland nexus: circles of cooperation and intermediaries in Brazil. Globalizations 1: 1-21. Fernandes B, Frederico S and Pereira LI (2019) Acumulação pela renda da terra e disputas territoriais na fronteira agrícola brasileira. Revista NERA (UNESP) 22: 173-201. Frederico S and Almeida MC (2019) Capital financeiro, land grabbing e a multiescalaridade na grilagem de terra na região do Matopiba. Revista NERA (UNESP) 22: 123-147. Frederico S (2019) From subsistence to financial asset: The appropriation of the Brazilian Cerrado land as a resource. Revista NERA (UNESP) 50: 239-260. Nascimento RC, Frederico S and Saweljew YM (2019) Financial capital and land control: New rentiers of the Brazilian agricultural frontier. Revista NERA (UNESP) 50: 261-286.