Follow the Money

Who is investing into agriculture, why, how, and where?

Introduction

Since the global financial crisis 2008/2009, the world has seen a stark rise in financial investment in farming and agricultural production. Who is investing into farmland as well as agricultural production (and often processing), why, how, and where?

The capital placement process of “finance-gone-farming” is structured by a set of complex socio-spatial relationships, that often stretch across many sites, and eventually link sources of capital placed somewhere to the ownership and steering of land and agricultural ventures elsewhere.[1]

The socio-spatial relations that emerged from this are complex and we are yet to fully understand how the agri-focused financial industry works in practice.

Our lack of knowledge of these issues is the outcome of a limited engagement of many agri-finance focused researchers with financial market players themselves. We see talk about finance capital without talking to finance capitalists. With a little bit of luck and the right strategy, however, it is possible to “follow the money”[2] and ground agri-finance in particular places. This is what this website wants to do.

[1] Keeley B and Love P (2010) Pensions and the Crisis. In From Crisis to Recovery: The Causes, Course and Consequences of the Great Recession, Keeley B and Love P (eds.): 68-87. Paris: OECD. [2] Christophers B (2011) Follow the Thing: Money. Environment and Planning D 29 (6): 1068-1084.

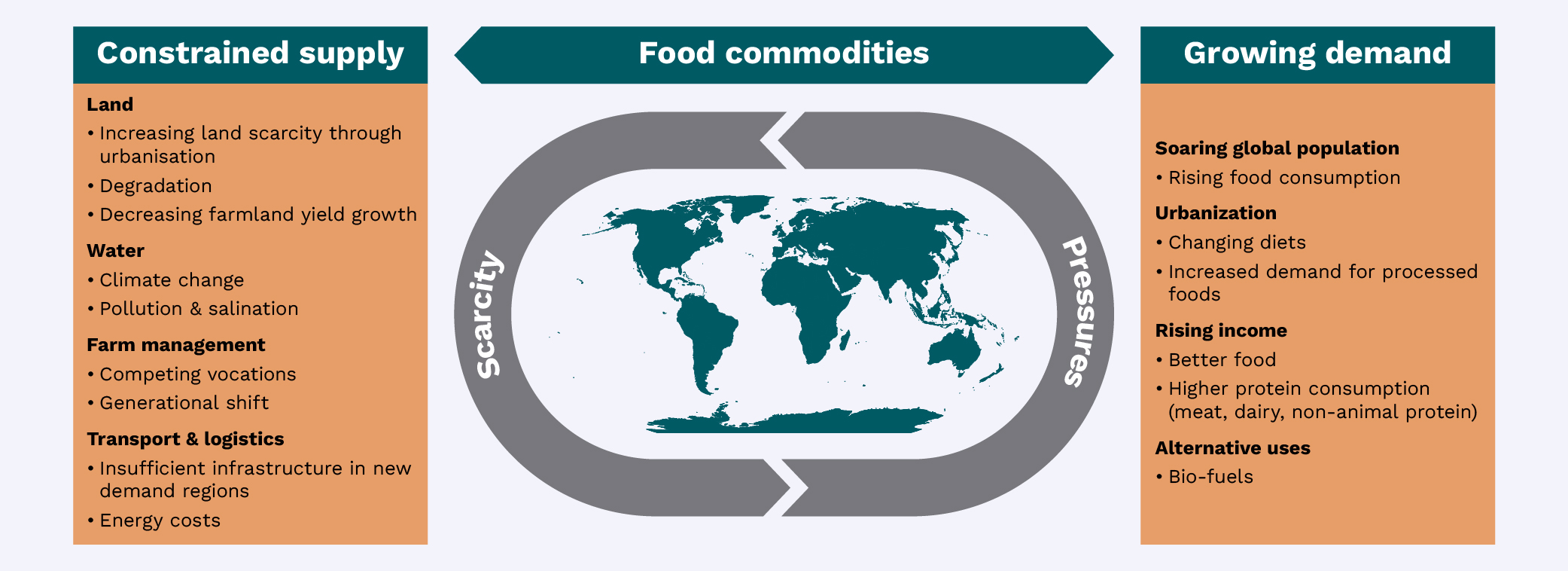

A stylized "scarcity-pressures" chart: This is how many agri-focused asset managers frame the current conjuncture. Source: own illustration.